22+ usaa reverse mortgage

Conventional Cash-out Refinance Loan 1 7625. They include FirstBank Quontic Bank MT Bank The Federal Savings Bank Townebank Goldwater.

Can A Family Member Be Added To A Hecm Reverse Mortgage

Web A reverse mortgage is a loan where a lender pays you instead of the other way around adding to the interest you owe and drawing down the equity in your home.

. Web A reverse mortgage increases your debt and can use up your equity. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web There are still many banks that offer reverse mortgages.

Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock. Web A reverse mortgage is self-explanatory in that it does the opposite of a traditional mortgage loan. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Reverse mortgages can help homeowners who are house-rich but cash-poor stay in their homes and still meet their financial obligations. Charges will be assessed with.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Web Reverse mortgage lenders are optimistic about the recently-announced rise of the Home Equity Conversion Mortgage HECM lending limit to 970800 in 2022 but. A variety of terms available.

Web Conventional refinance rate and term loans are available to USAA members who have their USAA mortgage serviced by Nationstar Mortgage and these charge an. Ad Looking For Reverse Mortgage Calculator. Web Refinance up to 95 of the value of your home private mortgage insurance may be required.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Web But the fee can unlock home ownership with no money down or with a small down payment without paying extra insurance year after year. Instead of borrowing money to buy a house you can use the equity in your home to.

Simple Reverse Mortgage Calculator. Web At the conclusion of a reverse mortgage the borrower must repay the loan and may have to sell the home or repay the loan from other proceeds. Web The Real Estate Settlement Procedures Act RESPA is applicable to all federally related mortgage loans except as provided under 12 CFR 10245b and.

Ad Save Money Protect Your Home. Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Find USAA Home Warranty Deals Now. To qualify for most reverse mortgages.

Compare New Home Owner and Current Home Owner Deals. If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Hear From USAA Home Warranty Providers In Minutes. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Estimate Your Potential Cash in Minutes.

National Association Of Mortgage Brokers

What Is A Reverse Mortgage Pros And Cons Explained

Managing Health Risks In Retirement Usaa

Reverse Mortgage Pros And Cons Bankrate

Seven Tip To Successful Retirement Planning Usaa

Mortgage Find Out If You Are Eligible For Reverse Mortgage The Economic Times

Suze Orman Says Yes To Reverse Mortgages Mls Reverse Mortgage Powered By Zyng Mortgage

Usaa Homeowners Insurance Review Money

Mortgage And Home Loans Usaa

7vww4qv5fokk5m

Usaa Federal Savings Bank Cuts 130 Real Estate Lending Jobs

Pros And Cons Of Reverse Mortgage Reverse Mortgage Cons

Pros And Cons Of Reverse Mortgages When Are They Worth Usin Menafn Com

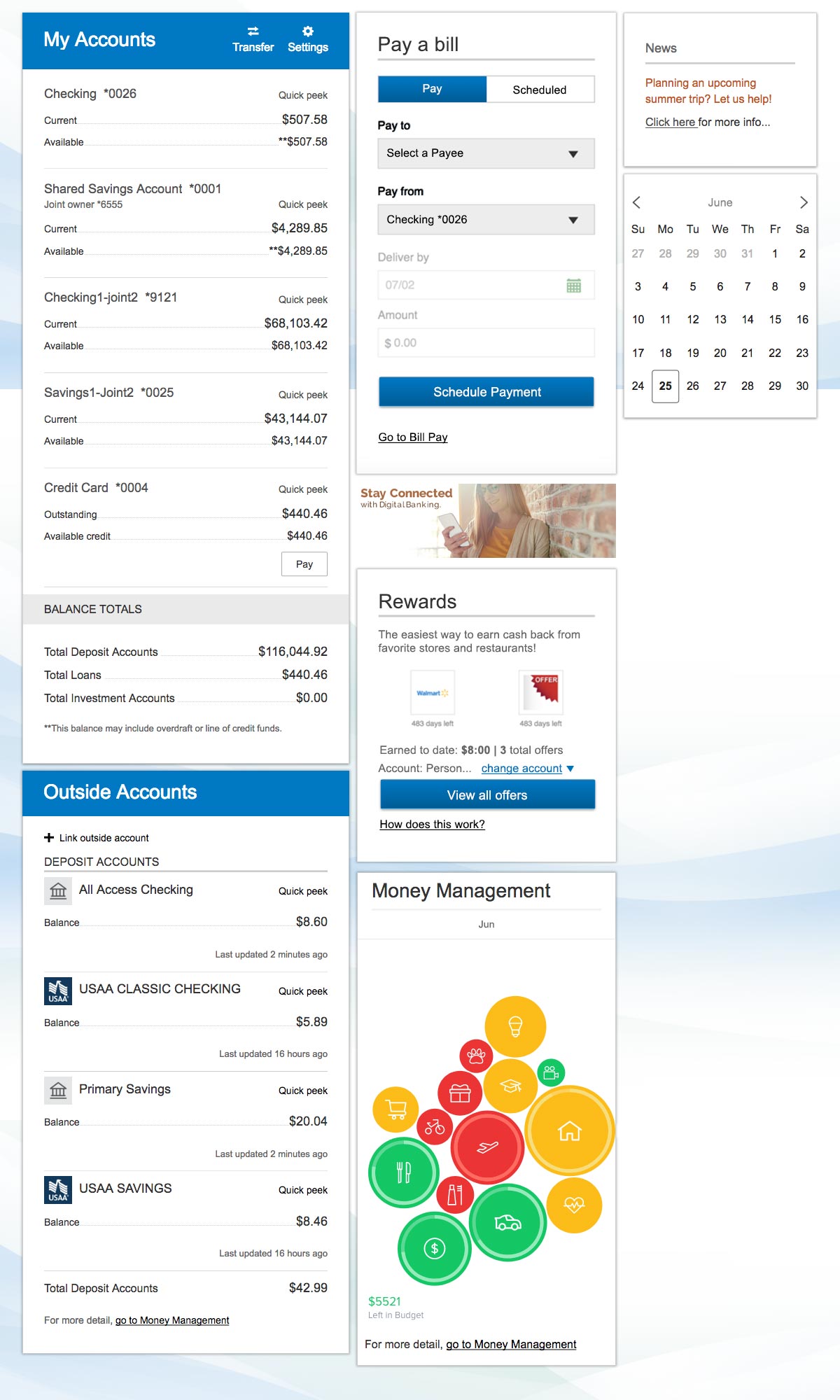

Washington Trust Online Banking

What Is A Reverse Mortgage

Navy Federal Credit Union Mortgage Review 2023

Reverse Mortgage Alternatives 5 Options For Seniors Credible